Automate Your UK Year-End Close: A Guide for SME Finance

Table of Contents

From Weeks to Days: How to Automate and Streamline Your UK Year-End Close

For decades, the “year-end close” has been synonymous with finance team heroics. It conjures images of late nights, endless takeaways, and a mountain of spreadsheets. Many SME founders and finance managers accept this chaos as the cost of doing business.

But in 2026, this approach is obsolete. The technology exists to transform the year-end from a frantic retrospective into a routine verification of data that is already clean.

Moving from a manual “hard close” to a streamlined, automated process isn’t just about saving time, it’s about gaining strategic agility. This guide explains how to automate the heavy lifting of the year-end, specifically focusing on the most time-consuming area: vendor management.

Why the Manual Close is Obsolete

The traditional closing process relies on “batch processing.” You wait until the month or year ends, then try to reconcile huge volumes of transactions at once. This creates:

-

Data Latency: By the time you report the numbers, they are weeks old.

-

Version Control Chaos: Managing a “Final_Final_v3.xlsx” spreadsheet leads to inevitable errors.

-

The “Forensic” Burden: Trying to remember why a specific vendor was paid £500 six months ago is inefficient.

To fix this, we must move toward a “Continuous Close”, where data is verified in real-time.

3 Pillars of a Streamlined Year-End

Automation is not a magic switch, it is a stack of tools and processes. To streamline your year-end, you need to address three specific layers.

1. Automating Data Collection (The Input)

The biggest bottleneck in any close is chasing paper. If your team is manually typing data from PDF invoices into your accounting software, you are wasting valuable time.

- The Fix: Implement Optical Character Recognition (OCR) tools and digital portals. Data should enter your system automatically, not via a keyboard.

2. Standardizing Vendor Management (The Process)

Inconsistent data is the enemy of automation. If one vendor is “Vendorfi Ltd” in your bank and “Vendorfi Limited” in your ERP, your automated reconciliation will fail.

- The Fix: You need a single source of truth. Implementing a standardized guide to effective vendor onboarding ensures that data is captured correctly the first time. When the data is clean at the source, the reconciliation at year-end becomes automatic.

3. Integrating Your Tech Stack (The Flow)

Your Vendor Management System (VMS) must talk to your accounting platform (like Xero, QuickBooks, or NetSuite). Siloed data requires manual export/import, which introduces risk.

- The Fix: Ensure your procurement workflows trigger automatic entries in your general ledger. For example, when a purchase order is approved in your vendor procurement guide workflow, the liability should automatically register in your accounts.

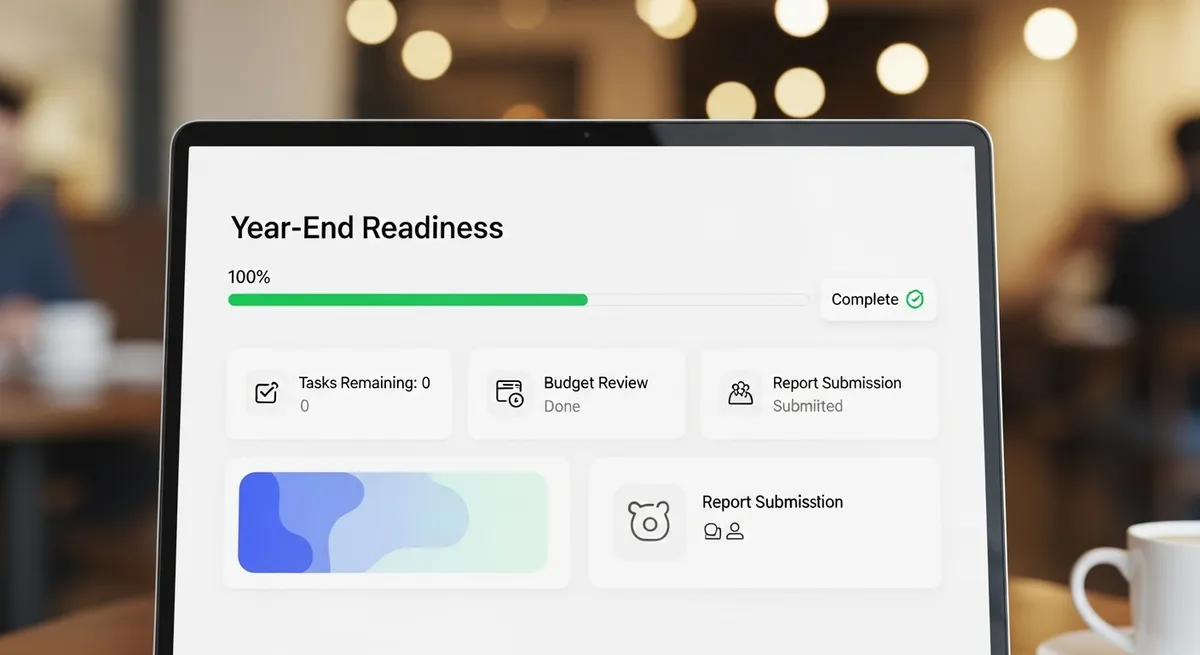

How Vendorfi Powers the “Continuous Close”

General accounting software handles the result of spending, but Vendorfi handles the cause of it: the relationship with the supplier. By automating the upstream processes, Vendorfi ensures the downstream accounting is effortless.

Self-Serve Onboarding

Instead of your team manually entering supplier tax codes and bank details, Vendorfi allows suppliers to enter this data themselves via a secure portal. This shifts the workload off your team and places the responsibility for accuracy on the vendor.

Centralized Audit Repository

When auditors ask to see a contract or a proof of compliance for a specific expense, you don’t need to dig through email archives. Vendorfi acts as a centralized repository. If you are measuring vendor performance KPIs throughout the year, the year-end review becomes a formality rather than a discovery process.

Real-Time Visibility on Liabilities

Manual processes often hide “accruals”, costs that have been incurred but not yet invoiced. Vendorfi provides visibility into open purchase orders and contracts, allowing you to accrue accurately without guessing.

The Impact: Manual vs. Automated

The difference between the two approaches is stark.

| Feature | The Manual Close | The Automated Close |

| Data Entry | Manual typing: prone to typos. | Automated capture: 99% accuracy. |

| Vendor Queries | Endless email ping-pong. | Self-service portal for vendors. |

| Reconciliation | ”Forensic” investigation of old data. | ”Exception-based” review of current data. |

| Compliance | Frantic search for contracts. | One-click access to all docs. |

| Time Required | 2-3 Weeks | 2-3 Days |

Steps to Implement Automation Before Your Next Year-End

You don’t have to overhaul your entire finance function overnight. Start with these steps:

-

Audit Your “Time Thieves”: Identify exactly where your team loses time. Is it chasing VAT invoices? Is it matching POs?

-

Cleanse Your Master Vendor File: Remove duplicate suppliers and archive old ones. A clean database is essential for automation.

-

Implement a VMS: Deploy a tool like Vendorfi to handle the operational side of supplier relationships.

-

Train on “Management by Exception”: Teach your team to trust the automation and only intervene when the system flags an anomaly.

Conclusion

The goal of automation is not to replace finance professionals but to elevate them. When you stop spending weeks copying and pasting data, you gain weeks to analyze what that data means for the future of your business.

Don’t wait for the next year-end panic to set in. Start automating your vendor management today and turn your next close into a non-event.

Frequently Asked Questions (FAQ)

Is automation only for large enterprises?

No. In fact, SMEs often benefit most because they have smaller teams. Automation acts as a “force multiplier,” allowing a single finance manager to handle a workload that would otherwise require three people.

How long does it take to implement a vendor management system?

Modern SaaS tools like Vendorfi are designed for rapid deployment. Unlike legacy ERPs that take months, you can often be up and running with a clean vendor list in a matter of days.

Will automation replace my accountants?

Automation replaces data entry, not accountants. It frees up your qualified professionals to focus on higher-value tasks like forecasting, cash flow analysis, and strategic advisory.

Manage your entire vendor lifecycle, from procure to pay - for free.

See how Vendorfi's automated platform can help you manage risk and reduce spend across your entire vendor portfolio.