A Practical Guide to Vendor Segmentation (Kraljic Matrix)

Table of Contents

A Practical Guide to Vendor Segmentation: Optimizing Your Supply Base

In any business, time and resources are finite. Yet, many procurement teams fall into the trap of trying to manage every supplier relationship with the same level of intensity. They spend as much energy troubleshooting an order for office supplies as they do managing a critical software partner. This “one-size-fits-all” approach is inefficient and risky. It dilutes the attention you can give to your most important partners and wastes valuable time on transactional vendors who simply need to be paid on time.

The solution to this resource imbalance is vendor segmentation. By classifying your suppliers into distinct groups based on their strategic importance and risk profile, you can tailor your management approach to maximize value. Segmentation is the engine that drives a successful Vendor Relationship Management (VRM) strategy, allowing you to shift your focus from reactive firefighting to proactive value creation. This guide will explore the most effective method for segmentation: the Kraljic Matrix, and show you how to apply it to your own supply base.

Understanding the Kraljic Matrix: The Gold Standard of Segmentation

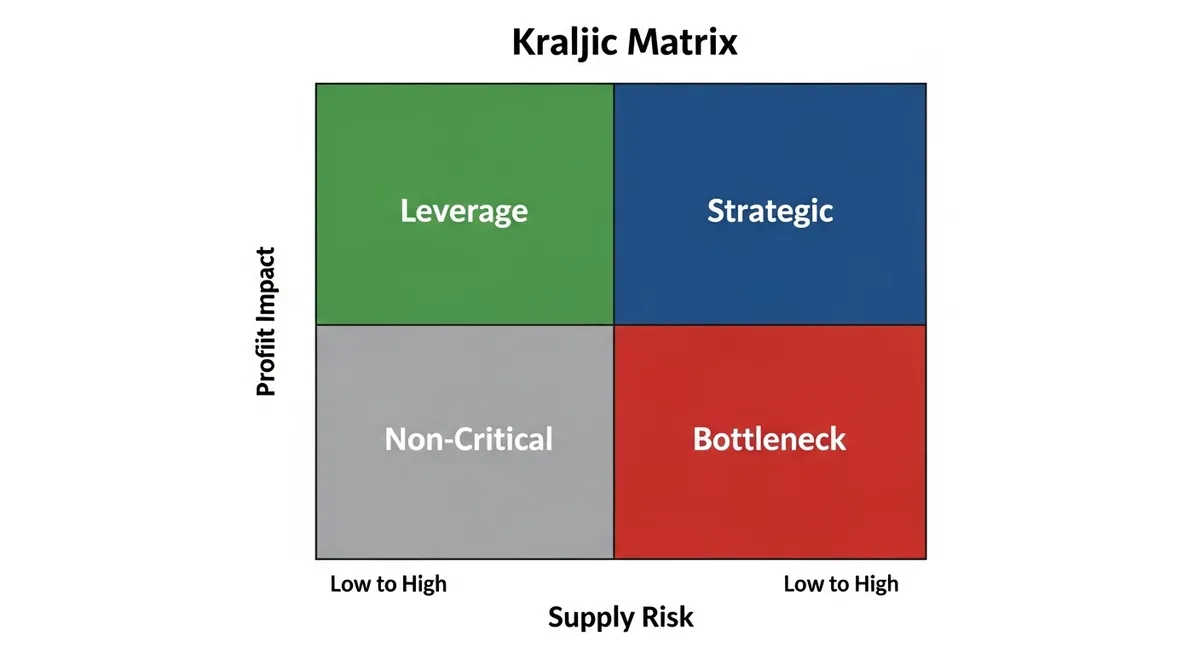

While there are many ways to categorize vendors, the Kraljic Matrix remains the gold standard in procurement. Developed by Peter Kraljic in 1983, this model moves beyond simple spend analysis. Instead of ranking vendors solely by how much money you pay them, it evaluates them across two critical dimensions: Profit Impact and Supply Risk.

-

Profit Impact (Spend Volume): This axis measures the sheer volume of spend with a vendor and their impact on your bottom line. It asks: How much does this vendor contribute to our profitability? Is this a high-cost item where small savings equal big returns?

-

Supply Risk (Market Complexity): This axis measures the complexity of the market and the risk of disruption. It asks: How easy is it to replace this vendor? Is the technology proprietary? Are there distinct logistical risks? This aligns closely with the principles of vendor risk management, ensuring you identify vulnerabilities before they become crises.

By plotting your vendors against these two axes, you can clearly see which relationships require a strategic partnership and which simply require efficient processing.

The 4 Vendor Categories and How to Manage Them

The intersection of Profit Impact and Supply Risk creates four distinct quadrants. Each category represents a different type of relationship and requires a unique management strategy. Understanding these distinctions is the key to optimizing your procurement resources.

| Category | Impact/Risk Profile | Management Goal | Strategy |

| Strategic | High Spend / High Risk | Partnership | Innovation & Collaboration |

| Bottleneck | Low Spend / High Risk | Security | Ensure Supply & Find Alternatives |

| Leverage | High Spend / Low Risk | Profitability | Competitive Bidding & Cost Reduction |

| Non-Critical | Low Spend / Low Risk | Efficiency | Automation & Consolidation |

1. Strategic Partners (High Spend, High Risk)

These are your most critical relationships. They provide goods or services that are essential to your core business, high in cost, and difficult to substitute. A disruption here would be catastrophic. The goal with strategic partners is not just to buy from them, but to collaborate with them. You should invest heavily in these relationships, conducting Quarterly Business Reviews (QBRs), sharing long-term roadmaps, and co-developing innovation.

2. Bottleneck Vendors (Low Spend, High Risk)

Bottleneck vendors are often the most frustrating category. You may not spend much money with them, but they hold a monopoly on a specific part, niche software, or service. If they fail, your operations stop. Because your leverage is low (due to low spend), your primary goal is supply security. You should maintain higher inventory levels if possible, secure long-term contracts to guarantee availability, and actively search for alternative solutions to reduce your dependency.

3. Leverage Vendors (High Spend, Low Risk)

This category represents your biggest opportunity for cost savings. These vendors provide essential goods or services where you spend a lot of money, but the market is full of capable competitors (e.g., computer hardware, fleet vehicles, standard raw materials). Because you have high buying power and low risk of lock-in, you should aggressively use vendor procurement tactics like competitive bidding and reverse auctions to drive down prices and improve terms.

4. Non-Critical Vendors (Low Spend, Low Risk)

These are the transactional vendors that keep the lights on for office supplies, maintenance services, and catering. The products are standardized and there are plenty of suppliers. The strategy here is efficiency. You should not spend time negotiating with these vendors. Instead, focus on automating the purchasing process, consolidating spend to fewer suppliers to reduce administrative overhead, and using catalogs for easy ordering.

Step-by-Step: How to Segment Your Own Vendors

Moving from theory to practice requires data. You cannot segment your vendors based on “gut feeling,” or you risk misclassifying a risky bottleneck vendor as a simple non-critical one. Follow these steps to build your segmentation model.

Step 1: Gather Spend and Performance Data

Start by exporting your accounts payable data to see exactly how much you are spending with each vendor. However, spend is only half the picture. You also need to look at performance history. Use your data on measuring vendor performance KPIs to identify reliability issues. A low-spend vendor that frequently delays shipments might actually be a high-risk bottleneck that needs re-classification.

Step 2: Map Vendors to the Matrix

Create a visual plot of your top vendors. Rate each one on a scale of Low-to-High for both “Spend” and “Risk.” Be honest about the risk factor: consider the scarcity of the product, the financial stability of the vendor, and the cost of switching to a competitor. Once plotted, they will naturally fall into one of the four quadrants.

Step 3: Define Strategies for Each Segment

Once your vendors are segmented, apply the appropriate resource model. Assign your senior vendor managers to the “Strategic” quadrant. Assign procurement specialists focused on cost reduction to the “Leverage” quadrant. For “Non-Critical” vendors, look for ways to put them on auto-pilot using purchasing cards or automated ordering systems.

Best Practices for Maintaining Your Segments

Vendor segmentation is not a one-time project, it is a living strategy. Markets change, vendor capabilities evolve, and your own business needs shift. To keep your segmentation effective, you must revisit it regularly.

-

Review and re-classify annually: A “Leverage” vendor might become a “Strategic” partner if they develop a new proprietary technology you need. Conversely, a “Bottleneck” vendor might become “Non-Critical” if a new competitor enters the market. Conduct an annual review to adjust your segments.

-

Don’t force a distribution: It is normal for the vast majority of your vendors to be “Non-Critical.” Do not try to force an even number of vendors into each quadrant. A healthy distribution often follows the Pareto Principle, where 80% of your vendors are transactional, and only a select few are truly strategic.

-

Align internal resources: Ensure your team’s time matches the segmentation. If your best talent is spending 20 hours a week managing office supply orders, your segmentation strategy is failing. Realign your human resources to focus on the High Risk/High Spend quadrants.

How Vendorfi Visualizes Your Vendor Landscape

Manually maintaining a segmentation matrix in spreadsheets can be tedious and prone to error. Vendorfi simplifies this process by digitizing your vendor data and automating the analysis.

Automated Spend Analysis

Vendorfi aggregates data from your financial systems to provide a real-time view of spend across your supply base. You can instantly identify your top-tier vendors by volume without manual calculation.

Centralized Risk Profiles

By centralizing compliance documents and performance data, Vendorfi helps you accurately assess the “Risk” axis of the matrix. You can tag vendors based on their segment (e.g., “Strategic,” “Bottleneck”) and filter your dashboard to view only specific groups. This ensures that when you are planning your QBRs or risk assessments, you are always focused on the right set of partners.

Conclusion: Focus Your Energy Where It Counts

Effective vendor segmentation is about working smarter, not harder. By using the Kraljic Matrix to categorize your suppliers, you can stop treating every vendor as a priority and start focusing your energy where it yields the highest return. This targeted approach lowers risk, reduces costs, and allows you to build deeper, more valuable partnerships with the vendors who truly matter to your business.

Frequently Asked Questions (FAQ)

What data do I need to start segmenting vendors?

At a minimum, you need annual spend data (total amount paid to the vendor) and a clear understanding of the market landscape for that vendor’s product (number of available competitors, ease of switching).

Can a vendor move between segments?

Yes, absolutely. A vendor can move from “Strategic” to “Leverage” if their product becomes commoditized. Similarly, a “Non-Critical” vendor can become “Bottleneck” if global supply chain shortages make their product hard to find.

What is the difference between “Strategic” and “Bottleneck” vendors?

The primary difference is spend and impact. Both are high risk, but Strategic vendors represent a large portion of your budget and are essential for profit. Bottleneck vendors usually represent a small spend but cause disproportionate operational pain if they fail.

About Harry Rock

The collective voice of our product, engineering, and operations teams, sharing insights to help you build better vendor relationships.

Manage your entire vendor lifecycle, from procure to pay - for free.

See how Vendorfi's automated platform can help you manage risk and reduce spend across your entire vendor portfolio.